How to Avoid Capital Gains Tax When Selling Your Home: Key Tips for Homeowners,

For many homeowners in Washington State, selling a home can come with significant financial benefits. One of the biggest concerns for sellers, however, is whether they will have to pay taxes on any profits they make from the sale. Fortunately, the federal tax code and Washington State laws offer some relief for homeowners through the Capital Gains Tax Exclusion for primary residences. Let’s break down what this means and how you can potentially avoid paying capital gains tax when selling your home.

For many homeowners in Washington State, selling a home can come with significant financial benefits. One of the biggest concerns for sellers, however, is whether they will have to pay taxes on any profits they make from the sale. Fortunately, the federal tax code and Washington State laws offer some relief for homeowners through the Capital Gains Tax Exclusion for primary residences. Let’s break down what this means and how you can potentially avoid paying capital gains tax when selling your home.

What Is Capital Gains Tax?

Capital gains tax is a tax on the profit made from the sale of a property or an investment. When you sell your home for more than you paid for it, the difference between the selling price and the purchase price is considered a capital gain. This gain is generally subject to federal capital gains tax, and in some states, it’s also subject to state taxes.

However, Washington State does not impose a state-level income tax on your personal residence, which means that, for most Washington homeowners, only the federal capital gains tax applies when selling their homes.

How Does the Capital Gains Tax Exclusion Work?

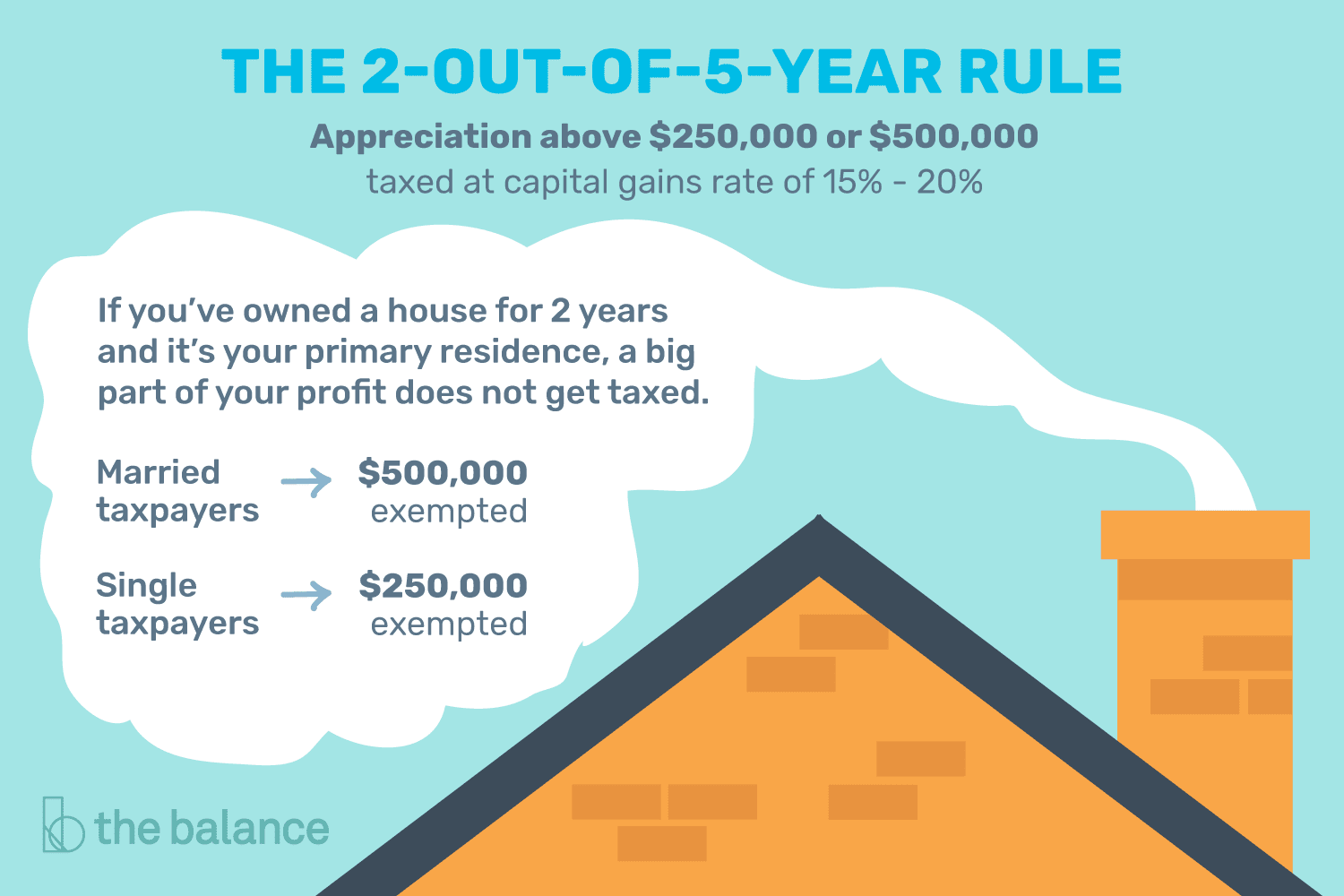

Under federal law, homeowners can exclude up to $250,000 of capital gains from the sale of their home if they are single, and up to $500,000 if they are married and file jointly. This means that, in many cases, homeowners can sell their primary residence without paying any capital gains tax at all, as long as certain conditions are met.

What Conditions Must Be Met to Qualify for the Exclusion?

To take advantage of the capital gains tax exclusion, the IRS requires that the following conditions be met:

-

Ownership Requirement:

- You must have owned the home for at least two of the last five years before the sale. The ownership does not need to be continuous, but it must total at least two years.

-

Use Requirement:

- You must have lived in the home as your primary residence for at least two of the last five years. Again, the two years don’t need to be consecutive.

-

No Other Capital Gains Exclusion in the Last Two Years:

- You cannot have claimed the capital gains exclusion on another home sale within the last two years. This rule is designed to prevent homeowners from flipping properties tax-free.

-

Primary Residence:

- The exclusion only applies to your primary residence, not second homes or investment properties. although there is a way to defer captial gains on investment property. We will go into more detail on this in another blog post.

Examples of How the Exclusion Works:

Let’s say you and your spouse bought your home in Lake Tapps 10 years ago for $300,000. Now, you’re selling it for $800,000, which means you’ve made a profit of $500,000.

If this was your primary residence, and you meet the ownership and use requirements, you can exclude the entire $500,000 gain from federal taxes. Essentially, you would owe no capital gains tax on the sale.

However, if you’re single and made the same $500,000 gain, you would only be able to exclude $250,000 of that profit from taxes. The remaining $250,000 would be subject to federal capital gains tax at a rate that could range from 0% to 20%, depending on your income level.

Partial Exclusion:

There are certain situations where a homeowner may qualify for a partial exclusion of capital gains. This may apply if you had to sell your home due to specific circumstances like a job change that required relocation, health reasons, or other unforeseen events. In these cases, you might be eligible for a prorated portion of the exclusion, even if you didn’t meet the full two-year requirement.

Washington’s Stance on Capital Gains:

Washington State, unlike many other states, does not have an income tax. Additionally, the state does not have a specific capital gains tax on the sale of primary residences. While the state does levy a capital gains excise tax on certain sales of stocks, bonds, and other assets, homes are generally excluded from this, meaning your home sale will not trigger a state capital gains tax.

This lack of a state capital gains tax can be a significant advantage to Washington residents, making it an even more appealing place to sell a home.

What If You Exceed the Exclusion Limits?

In the event that your profit exceeds the capital gains exclusion limits (for example, if you are a single filer who made more than $250,000 in profit on your home), you will be required to pay capital gains tax on the amount exceeding the exclusion. We recently had this happen with a client of ours. She had bought her home when she was single and then married her husband and never changed the title to add his name

Federal capital gains taxes are calculated at rates of 0%, 15%, or 20%, depending on your taxable income. Most homeowners fall into the 15% bracket. There may also be an additional 3.8% Net Investment Income Tax (NIIT) if your income exceeds certain thresholds ($200,000 for single filers and $250,000 for married couples filing jointly).

Tips for Reducing Your Capital Gains:

Even if your home’s sale exceeds the exclusion limits, there are ways to reduce the amount of profit subject to capital gains tax:

- Home Improvements: The cost of major home improvements, such as a kitchen remodel or adding a deck, can be added to your home’s original purchase price, reducing your taxable gain.

- Selling Costs: Expenses like real estate agent commissions, title insurance, and transfer taxes can also be subtracted from your sale price, reducing the taxable gain.

- Document Everything: Keep thorough records of home improvements and selling expenses. These documents are essential for calculating your actual gain and maximizing the exclusion.

Final Thoughts:

For many Washington homeowners, the capital gains tax exclusion on primary residences offers an opportunity to keep more of the profit from selling their home. By meeting the ownership and use requirements and understanding the exclusions, you may be able to avoid paying any capital gains tax on the sale of your home. If you are getting ready to sell your home and would like to talk to a real estate agent who is familiarized with Capital Gains Tax give us a call at Rethinking Real Estate. We would love to help you save more money.

As always, it’s a good idea to consult with a tax advisor or real estate professional to make sure you’re taking advantage of all the tax breaks available to you.

💡 Curious about more homeownership tips? Follow us at Rethinking Real Estate for insights and advice that keeps you informed! We have more blog posts at

or go to our youtube channel at

Categories

- All Blogs (105)

- Inheritance & Estate Planning (4)

- Auburn real estate (12)

- Bonney Lake Housing Market (4)

- Bonney Lake real estate (12)

- Buyer & Seller Advice (13)

- closing a home sale in Washington (7)

- common mistakes that delay real estate closings (3)

- contingent offer pros and cons Pierce County (1)

- Contingent Offers Explained (1)

- Downsizing & Retirement Living (3)

- Home Buying Advice (3)

- home closing tips Lake Tapps (6)

- home sale contingency Lake Tapps (2)

- Home Selling Advice (15)

- Home Selling Strategies (15)

- how escrow works when buying a house (2)

- how to protect your funds during a home purchase (1)

- Lake Tapps Real Estate (13)

- leaving home to kids (2)

- Pierce County Real Estate (14)

- Pierce County Real Estate Tips (12)

- Real Estate Closing Process (4)

- Real Estate Market Trends (9)

- real estate professionals in Western Washington (7)

- Real Estate Tips (14)

- real estate wire fraud prevention (1)

- senior living (3)

Recent Posts

If you haven't subscribed to our newsletter, you're missing out on great stories like the one above that could be coming right to your inbox every few weeks.

Please use the form to request a subscription.