Why Young Buyers Are Teaming Up to Own Homes Together!

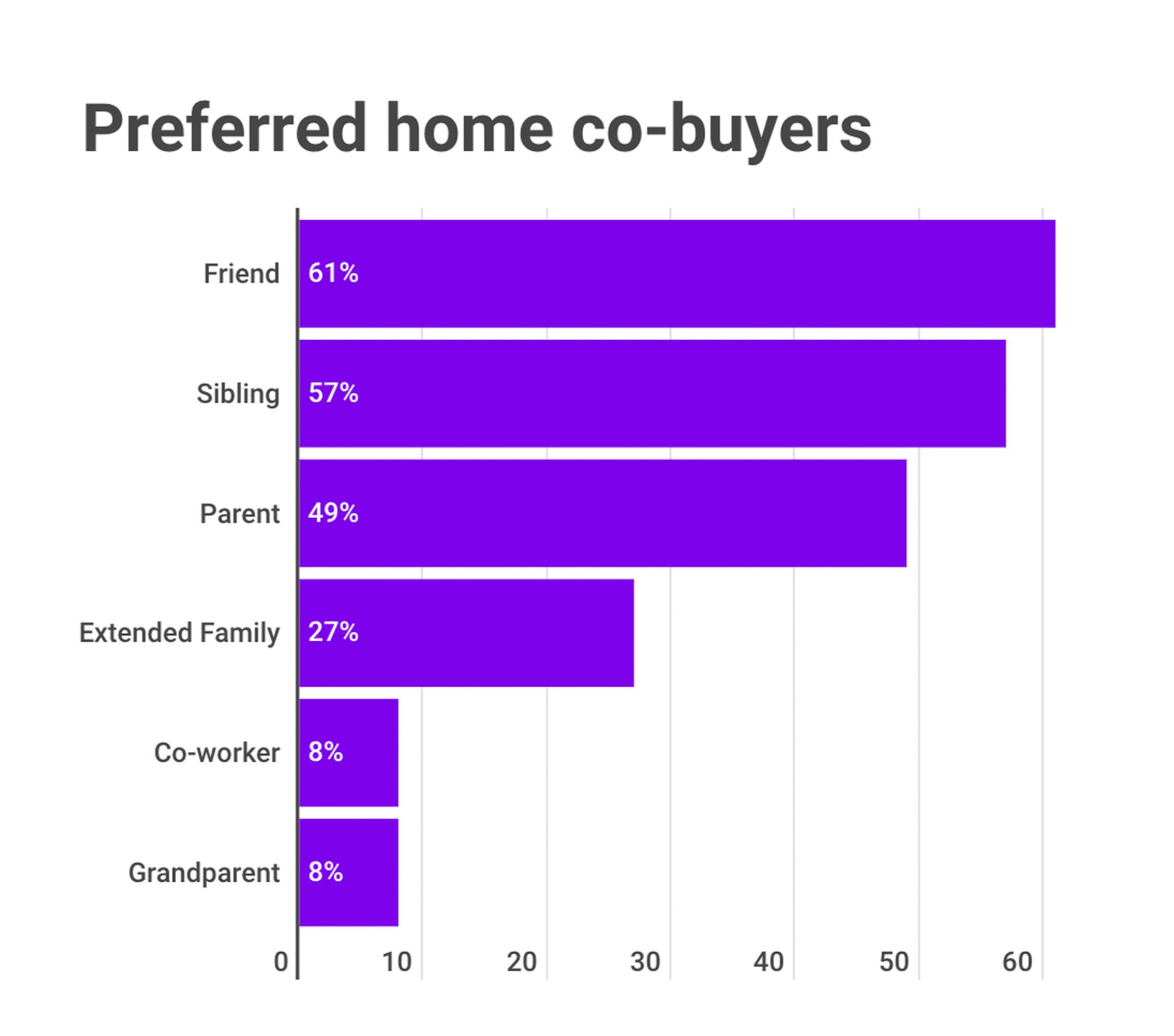

In today’s challenging housing market, traditional paths to homeownership are evolving. As an agent working with younger clients, I’ve noticed a growing trend: more people are considering buying homes with their friends. This approach isn’t just about making a financial investment; it’s about finding innovative ways to achieve the American Dream.

The idea might seem unconventional, but it’s gaining traction for good reason. With rising real estate prices and the challenge of securing a mortgage alone, co-buying with friends offers a practical and financially savvy solution. Co-buying allows people to pool their resources, secure a home now, and set up a potential investment for the future.

Benefits of Co-buying a Home with Friends

The financial benefits are significant. For first-time buyers, sharing the cost of a down payment and mortgage makes homeownership more accessible. It’s also an opportunity to invest together, either by living in the home or renting it out. Plus, the day-to-day responsibilities of homeownership—like maintenance and upkeep—can be shared among co-owners, reducing the burden on any one person.

Beyond finances, there’s something appealing about building a community with friends. Living together creates a support system that many people crave in today’s individualistic culture. It’s not just about sharing a house; it’s about creating a lifestyle that fosters connection and collaboration with people you care and share a life and stories with.

Risks of Co-buying a Home with Friends

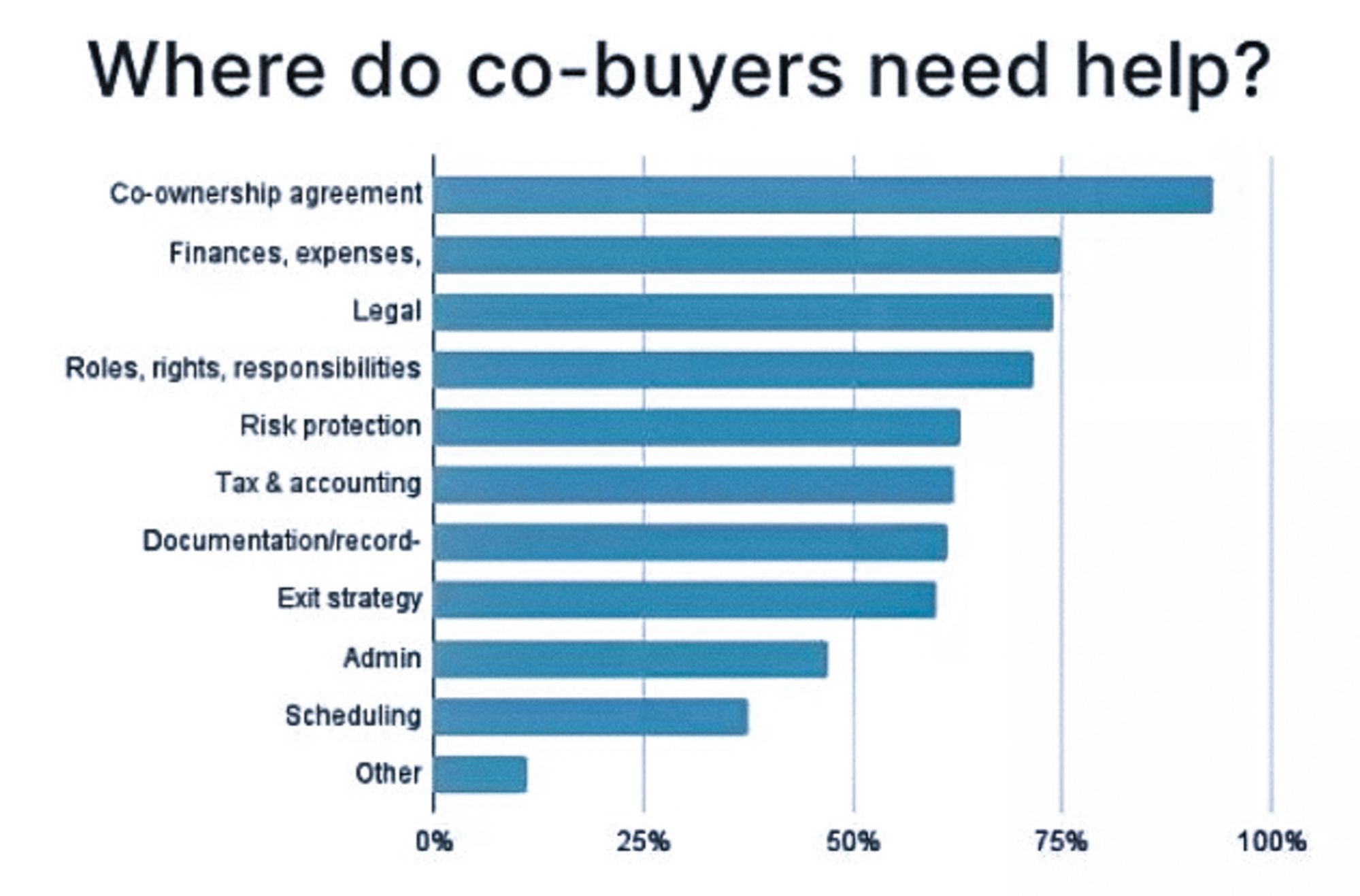

However, co-buying does come with its challenges. Finances can be a sensitive subject, and when purchasing a home with friends, it’s essential to have open and honest discussions about money. You’ll need to review each other’s credit scores, agree on how to divide expenses, and clearly define each person’s responsibilities. It’s important to note that disagreements are common—nearly half of first-time co-buyers have multiple arguments throughout the home-buying process.

To reduce these risks, it's essential to have a well-thought-out plan. Before signing any papers, consult with a real estate attorney to fully understand your rights and responsibilities. You’ll need to establish how you’ll manage mortgage payments, handle repairs, and navigate worst-case scenarios, such as job loss or the passing of a co-owner. Life can bring unexpected changes, so it's also important to discuss situations like meeting someone new and wanting to start a life with them, or needing to care for an out-of-state family member. Addressing these possibilities in writing now can help prevent significant issues later on.

How to Co-buy a Home

If you’re seriously considering co-buying, start by talking to a local real estate attorney to navigate the legal aspects. Then, speak with a mortgage lender to understand your financing options and get pre-approved for a loan. Finally, talk to a real estate agent who has done these types of transaction before, like us. They are a little different so you want to make sure you have an agent that understands how the contract is going to be written up and handles with escrow. Make sure to account for local taxes and other expenses that online calculators might overlook. And importantly, agree on an exit plan—how long you’ll own the home before selling.

Is Co-buying Right for You?

Co-buying may not be the right choice for everyone, but for many young people, it presents a compelling alternative to traditional homeownership. It's a practical way to break free from the renting cycle, start building equity, and achieve the dream of owning a home sooner. For many homebuyers, especially those feeling priced out of the market, this option opens up new possibilities they may not have previously considered. It’s an innovative approach that’s becoming increasingly relevant in today’s housing landscape.

If you’re curious about exploring co-buying further, I’ve done the research and can guide you through the entire process. Reach out to discuss the pros, cons, and everything in between to see if co-buying with friends might be your path to homeownership. At Rethinking Real Estate, we’re dedicated to finding innovative ways to help people achieve their homeownership dreams, and we’re here to support you every step of the way.

Categories

- All Blogs (84)

- Inheritance & Estate Planning (1)

- Auburn real estate (1)

- Bonney Lake Housing Market (1)

- Bonney Lake real estate (2)

- Buyer & Seller Advice (2)

- closing a home sale in Washington (2)

- common mistakes that delay real estate closings (1)

- contingent offer pros and cons Pierce County (1)

- Contingent Offers Explained (1)

- Downsizing & Retirement Living (1)

- Home Buying Advice (1)

- home closing tips Lake Tapps (1)

- home sale contingency Lake Tapps (1)

- Home Selling Advice (2)

- Home Selling Strategies (3)

- how escrow works when buying a house (2)

- how to protect your funds during a home purchase (1)

- Lake Tapps Real Estate (1)

- leaving home to kids (1)

- Pierce County Real Estate (2)

- Real Estate Market Trends (1)

- real estate professionals in Western Washington (1)

- Real Estate Tips (2)

- real estate wire fraud prevention (1)

- senior living (1)

Recent Posts

If you haven't subscribed to our newsletter, you're missing out on great stories like the one above that could be coming right to your inbox every few weeks.

Please use the form to request a subscription.