Navigating the world of real estate comes with its share of complexities, and one of the more crucial aspects to understand is the excise tax. If you're considering buying or selling property in Washington State, it's important to be aware of the Real Estate Excise Tax (REET) and how it may impact your transaction.

What is the Real Estate Excise Tax (REET)?

In Washington State, the Real Estate Excise Tax, commonly known as REET, is a tax on the sale of real property. This tax is typically paid by the seller and is based on the sale price of the property. The REET applies to all real estate transactions, including residential, commercial, and industrial properties.

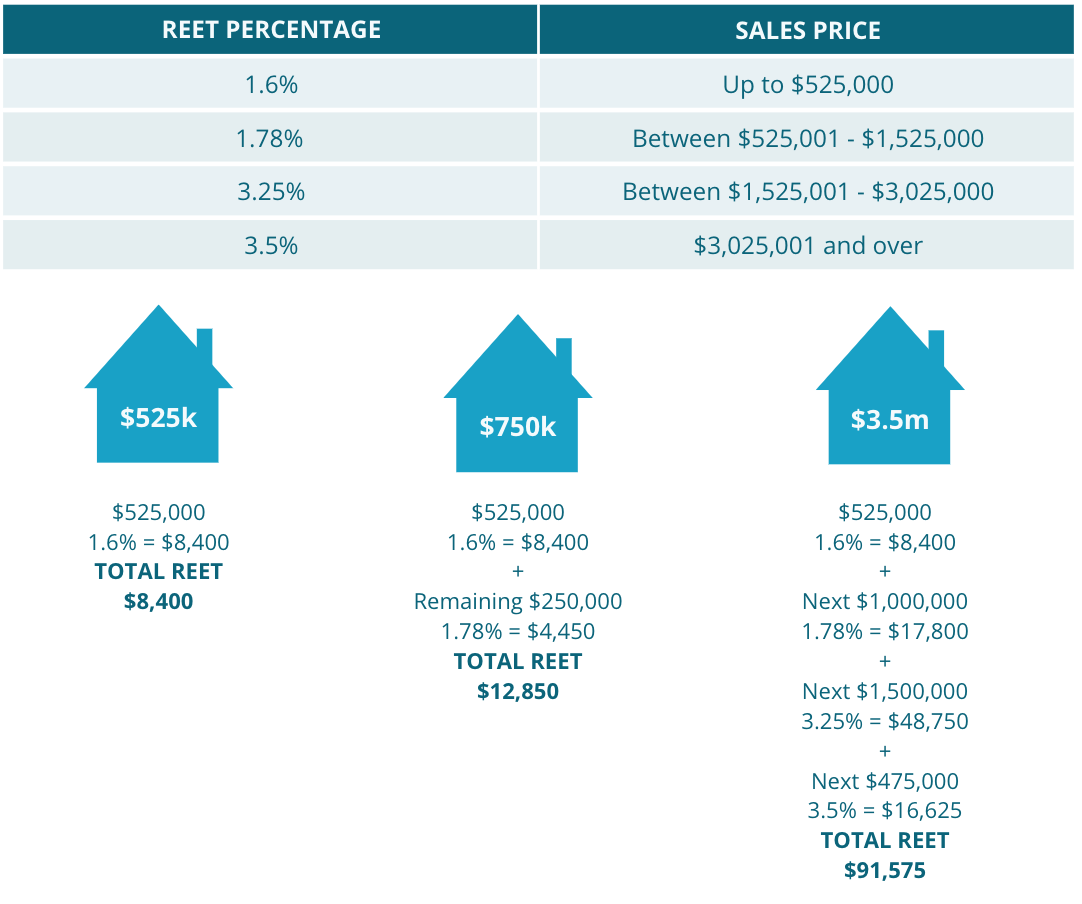

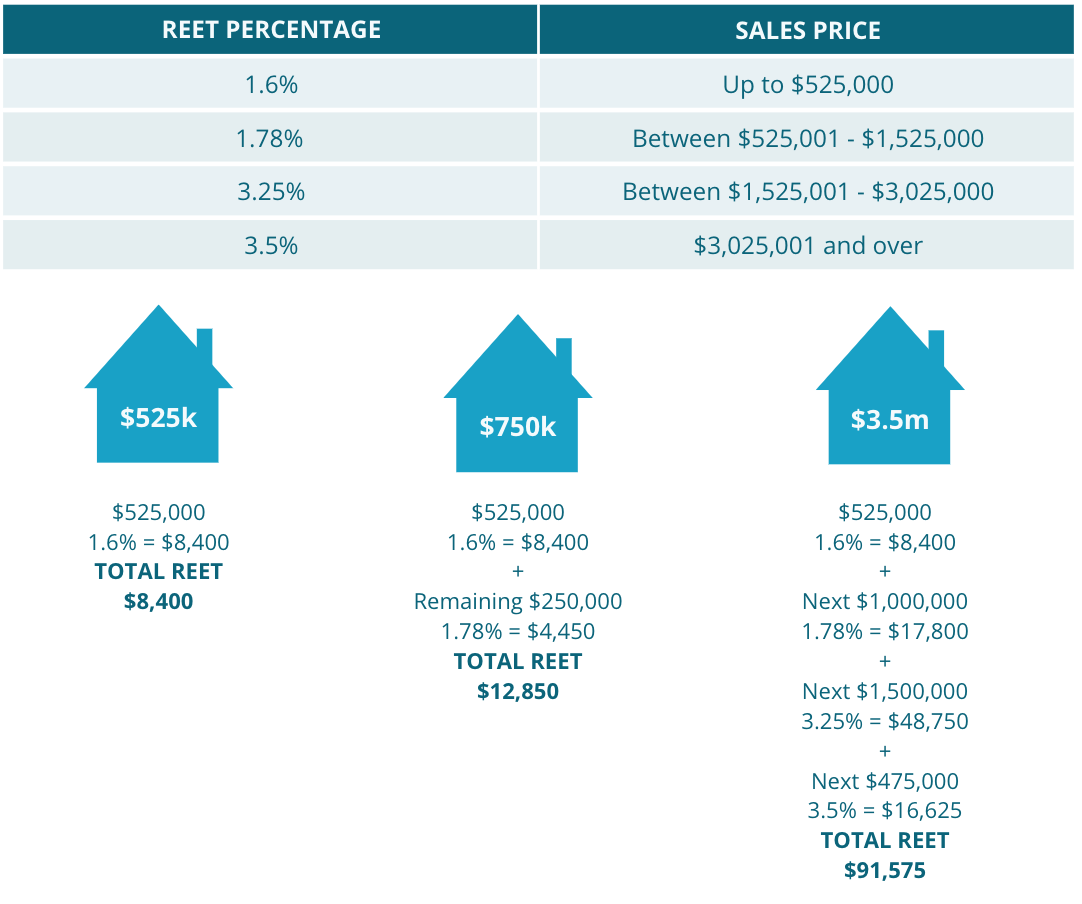

As of 2020, the tax rate varies depending on the location and the sale price of the property. As of recent changes, the state REET is progressive, meaning the tax rate increases with the value of the property. Here’s a quick breakdown of the state REET rates:

- 1.1% on the portion of the sale price up to $525,000

- 1.28% on the portion of the sale price between $525,001 and $1,525,000

- 2.75% on the portion of the sale price between $1,525,001 and $3,025,000

- 3% on the portion of the sale price over $3,025,000

Additional City Tax: What You Need to Know

On top of the state REET, certain cities have implemented their own excise tax, adding an additional layer of cost for sellers. This city-specific tax can range from 0.25% to 0.50% of the sale price. For example, if you're selling a property in a city that imposes an additional 0.50% REET, you'll be required to pay this amount on top of the state REET.

These additional taxes are usually earmarked for local projects, such as infrastructure improvements or affordable housing initiatives, making it important to be aware of the specific rates in your city.

Calculating Your REET:

Let’s break it down with two examples:

Example A: If you're selling a home in Oakville, Washington, for $600,000, and the local REET is 0.25%, the calculation would be:

- First $525,000: 1.35% (1.1% state + 0.25% local) = $7,087.50

- Remaining $75,000: 1.53% (1.28% state + 0.25% local) = $1,147.50

Total REET: $8,235

Example B: For a home sold in Seattle for $4 million, where the local REET is 0.5%, the calculation would be:

- First $525,000: 1.60% (1.1% state + 0.5% local) = $8,400

- Next $1,000,000: 1.78% = $17,800

- Next $1,500,000: 3.25% = $48,750

- Remaining $975,000: 3.5% = $34,125

Total REET: $109,075

These examples illustrate how quickly REET can add up, so it’s wise to plan accordingly. For personalized advice on your specific situation, always consult with a real estate professional who can run the numbers for you and give you an idea of how much you are going to pay.

Who is Exempt from the REET?

While most real estate transactions are subject to REET, there are certain exemptions:

- Gifts: Transfers of real property that are considered gifts are typically exempt from REET.

- Inheritances: Properties passed on through inheritance may be exempt, depending on the specific circumstances.

- Divorce Settlements: Transfers of property between spouses as part of a divorce settlement are generally exempt from REET.

- Community Property Agreements: Transfers between spouses or domestic partners under a community property agreement are often exempt.

When Do You Pay the REET?

The REET is paid at the time of the sale, usually as part of the closing process. The tax is collected by the county where the property is located, and it must be paid before the sale can be officially recorded. The responsibility for paying the REET typically falls on the seller, but it's essential to review your sales contract as it can sometimes be negotiated differently.

Final Thought!

Understanding the Real Estate Excise Tax (REET) is essential for anyone involved in a property transaction in Washington State. By being informed about how REET works, the applicable rates, and potential exemptions, you can better anticipate the costs associated with your sale or purchase. This knowledge empowers you to make strategic decisions, ensuring a smoother transaction and helping you avoid any unexpected financial surprises at closing. Always consult with a real estate professional to navigate these complexities, so you can confidently manage your real estate investments.