Cost Segregation: The Tax Strategy I Wish I’d Known About 20 Years Ago

I spent two decades as a landlord and real estate investor before I ever heard the term “cost segregation.” That’s not something I say with pride—it’s more like one of those "I wish someone had told me sooner" moments. Because once I learned what a cost segregation study was, I realized I had missed out on years of tax savings I could’ve been using to reinvest, grow faster, or just keep more of what I earned.

If you’re just getting started with investment property, or even if you’ve owned rentals for a while, this might be one of those lightbulb moments for you too.

What Is a Cost Segregation Study?

In plain terms, it’s a way to get more tax deductions faster, from your investment property.

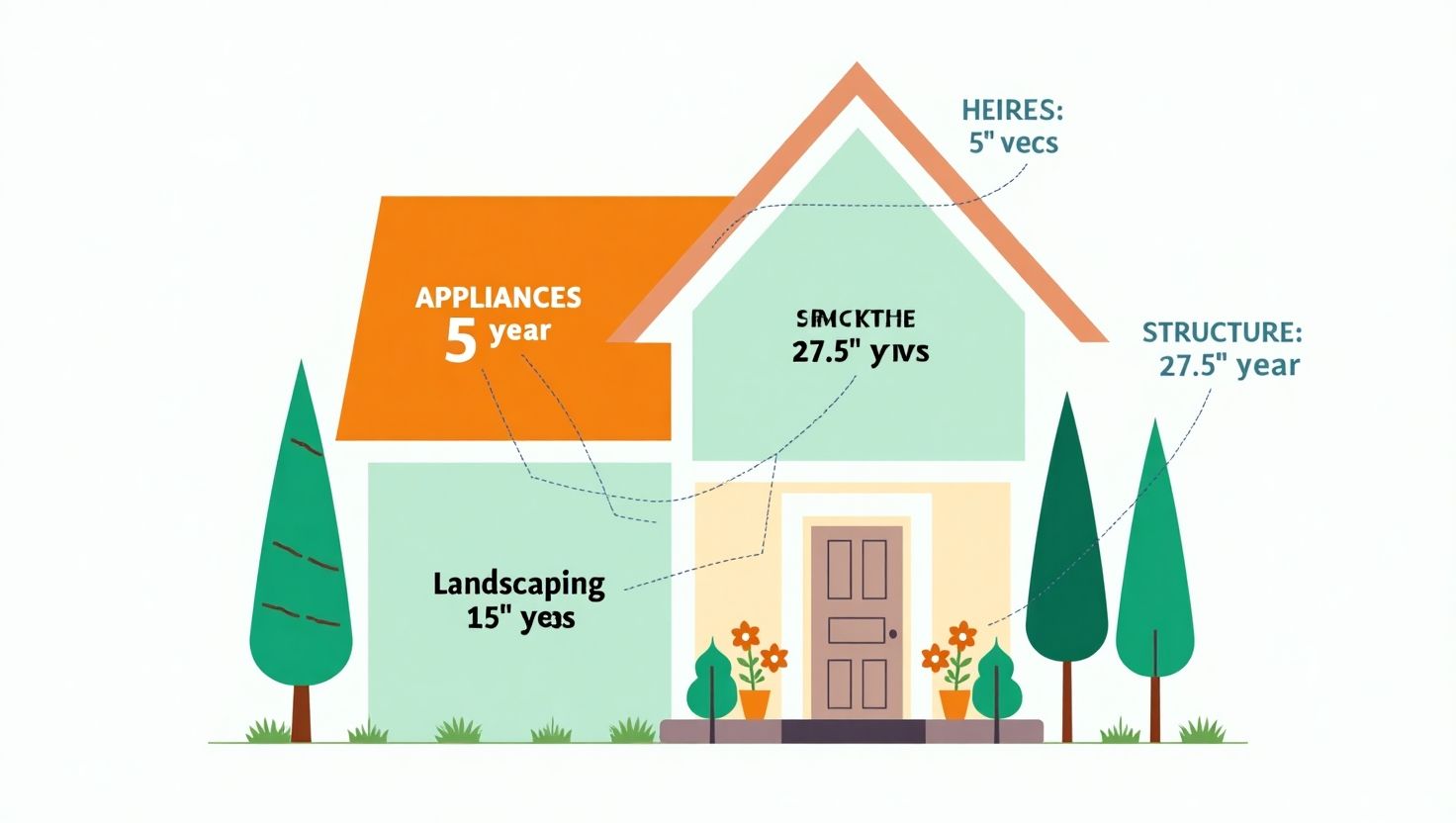

Normally, the IRS says you can depreciate a residential rental property over 27.5 years. That means each year you write off a small portion of the property’s value. Not bad, but not very exciting either.

With a cost segregation study, you're essentially breaking down the property into smaller parts—things like flooring, appliances, landscaping, and even sidewalks. And here’s the magic: a lot of those things can be depreciated much faster—over 5, 7, or 15 years.

So instead of waiting nearly three decades to write off your investment, you front-load those deductions. And that can lead to serious tax savings.

A Simple Example

Let’s say you buy a rental home for $525,000, with the building portion valued at $262,500 (the rest is land, which you can’t depreciate). Without a cost seg study, you’d depreciate the $262,500 over 27.5 years, about $9,545 per year.

With a cost seg study, you might reclassify $80,000 of that building into faster-depreciating assets like carpet, cabinets, landscaping, etc. That $80,000? You could potentially deduct all of it in Year One thanks to “bonus depreciation.”

First-year depreciation jumps from $9,545 to more than $86,000.

If you’re in a 32% tax bracket, that’s the difference between saving about $3,000 vs. nearly $28,000, right off the bat.

What’s the Catch?

This isn’t a DIY move. You’ll need a specialist, usually a firm that combines engineering and tax expertise, to do the analysis and documentation properly. A study can cost $3,000 to $5,000, depending on the size of the property. (I have an analyst I can refer you to.)

And if you’re not a real estate professional (in the IRS’s eyes), you may not be able to offset your earned income with this benefit, but If you have passive income, from this property or others, you can likely use the tax losses right away to offset that. And if not, no worries. Any unused losses don’t go to waste, they carry forward to future years and can even help reduce taxes when you eventually sell.

So even if the savings aren’t instant, they still add up.

Why It Matters

A cost segregation study isn’t just a tax move. It’s one of the “side benefits” of real estate investing that too many people never hear about. Especially early on. And honestly, I wish someone had pointed it out to me years ago.

So if you’re buying your first rental, or even your fifth, now’s the time to ask your CPA whether it’s worth exploring. It could put thousands of dollars back in your pocket, and maybe even give you a little momentum to keep building.

Want to Talk It Through?

I’m not a tax advisor, and this definitely isn’t tax advice. But I’ve been around the block a few times and can help point you in the right direction. If you want to explore whether a cost segregation study makes sense for your situation, or just talk strategy, feel free to call me directly at 253-255-1299.

You’ve got options. Let’s make sure you know about them.

--Don Karstedt

Prefer a different format?

You can also:

Categories

- All Blogs (105)

- Inheritance & Estate Planning (4)

- Auburn real estate (12)

- Bonney Lake Housing Market (4)

- Bonney Lake real estate (12)

- Buyer & Seller Advice (13)

- closing a home sale in Washington (7)

- common mistakes that delay real estate closings (3)

- contingent offer pros and cons Pierce County (1)

- Contingent Offers Explained (1)

- Downsizing & Retirement Living (3)

- Home Buying Advice (3)

- home closing tips Lake Tapps (6)

- home sale contingency Lake Tapps (2)

- Home Selling Advice (15)

- Home Selling Strategies (15)

- how escrow works when buying a house (2)

- how to protect your funds during a home purchase (1)

- Lake Tapps Real Estate (13)

- leaving home to kids (2)

- Pierce County Real Estate (14)

- Pierce County Real Estate Tips (12)

- Real Estate Closing Process (4)

- Real Estate Market Trends (9)

- real estate professionals in Western Washington (7)

- Real Estate Tips (14)

- real estate wire fraud prevention (1)

- senior living (3)

Recent Posts

If you haven't subscribed to our newsletter, you're missing out on great stories like the one above that could be coming right to your inbox every few weeks.

Please use the form to request a subscription.